In recent weeks, the world’s richest man and his flailing attempts to figure out what to do with Twitter have dominated the news cycle. However, his unhinged management-by-tweets reality show are nothing compared to an almighty tussle between two crypto-bros.

Internet magic money (aka crypto) billionaire Sam Bankman-Fried, better known as SBF, is the man behind FTX, a crypto exchange. He seems to have angered fellow magic money billionaire and fremeny, Changpeng Zhao, better known as CZ and CEO of the rival exchange Binance. It might have to do with FTX cozying up to regulators to get the regulations beneficial to the FTX but not its rivals.

Last week, the FTX balance sheet was leaked to crypto news site Coindesk, which effectively caused a run on the exchange by exposing the financial ties between FTX and Alameda Research, a crypto trading firm also owned by SBF. The balance sheet showed that FTX’s finances were a paper tiger and ripe for plundering.

There followed a jujitsu move by which the Binance chief created a market run on FTX. His firm dumped the FTX tokens they were holding, essentially telling the market they had no faith in them. “CZ outsmarted SBF, plain and simple,” a friend who is deeply involved in this industry told me of the clashing egos. “CZ helped SBF create FTX, let him grow it, and then when it got too big, he destroyed it.”

CZ, in an ironic Robinhood act that SBF himself pioneered with other failing crypto firms, announced that he was buying SBF’s empire in a move to “save” FTX. A day later he declared, “no deal” as FTX is a big hairball and not worth the hassle. Now that’s a proper decimation of a competitor. The whole thing is quite messy – much like the whole crypto ecosystem, which is supposed to be open and transparent but is more opaque than a dog with glaucoma.

If this whole thing looks like a Ponzi scheme involving magic Internet money, then it just might be – as the Substack Dirty Bubble Media outlines in this post. Feel free to follow VC-twitter and read their threads. Whatever you do, beware of those promising endless good times, unicorns and money raining from the skies.

When watching this whole drama unfold, the thing that stands out is the omnipresence of Bankman-Fried. You can’t avoid his face on billboards around San Francisco. The FTX logo is emblazed on cricket fields across the world, especially at the World T20 Championship, currently underway in Australia. He has appeared on the cover of Fortune magazine, and has been the subject of countless profiles. Some even talked him up as the new J.P. Morgan.

Sam Bankman-Fried is just thirty and has built a fortune said to have hit $26 billion at its peak. He once boasted that he could buy Goldman Sachs. His modest image, a scruffy haired guy who drives a Toyota Corolla and only ever wears basic t-shirts and shorts, suggested an everyman billionaire. It turns out that most of FTX’s success was due to some very fancy financial engineering that was long on promise and short on delivery.

It is incredulous that the media repeatedly plays the same game: it heralds these new faces and splashes them across their front pages without digging deeper.

At the turn of the century the then “smartest man in the room,” Enron CEO Jeff Skilling, could do no wrong — until he of course did do wrong and in the process took down his entire enterprise and wound up in prison. The story of FTX is remarkably similar — a lot of perceived success built on smoke and mirrors.

Enron wanted to make markets in everything from energy to bandwidth. Wall Street valued the company on its ability to conjure up revenues and profits from trading activity.

To refresh your memory, here’s how Enron abused the system:

- Enron used special purpose entities (SPEs) to hide debt and inflate profits.

- Enron used mark-to-market accounting to book profits on long-term contracts even when there was no cash flow.

- Enron engaged in round-trip trades to create the illusion of trading activity.

- Enron used complex financial instruments.

Enron’s elaborate scheme of intertwined entities essentially created ghost trades. This is a slight oversimplification, but you get the gist. It now looks like FTX and Alameda Research have been playing a variation of the same game. They used a technique called Basis Trading to game the system.

This is how it worked: FTX would create a synthetic token that tracked the price of Bitcoin but with leverage. So, if Bitcoin went up by 10 percent, the FTX token would go up by 20 percent. Of course, if Bitcoin prices fell, the losses would double. These tokens were not real Bitcoin but a creation of FTX, their own tokens. The company used their gains to raise cash by using their own tokens as collateral for loans. Tiger Global, Sequoia Capital, Softbank, Lightspeed, Temasek, Blackrock and others invested over a billion in the company which at one time was valued at $32 billion. FTX and Alameda Research’s intermingled ownership should have raised eyebrows, but history shows greed trumps diligence.

When Binance decided to dump their holdings of FTX tokens, the price of the token plummeted, taking the FTX exchange with it. As a reporter or investor, getting swept up in what seems like a good story isn’t difficult. Imagine meeting a thirty-year-old MIT graduate, a son of Stanford professors, who earned his stripes at a quant trading firm before starting his own crypto firm and exchange to thumb his nose at the system and do the impossible — that’s a cover story that writes itself. Fortune did and labeled him the next Warren Buffet.

Enron’s fall shattered lives, ruined savings and 401k plans, and opened the door to government regulation and increased scrutiny. Enron’s fraud had long-term ramifications, especially in Washington, DC. We got the Sarbanes-Oxley Act and increased penalties for destroying, altering, or fabricating records in federal investigations or for attempting to defraud shareholders.

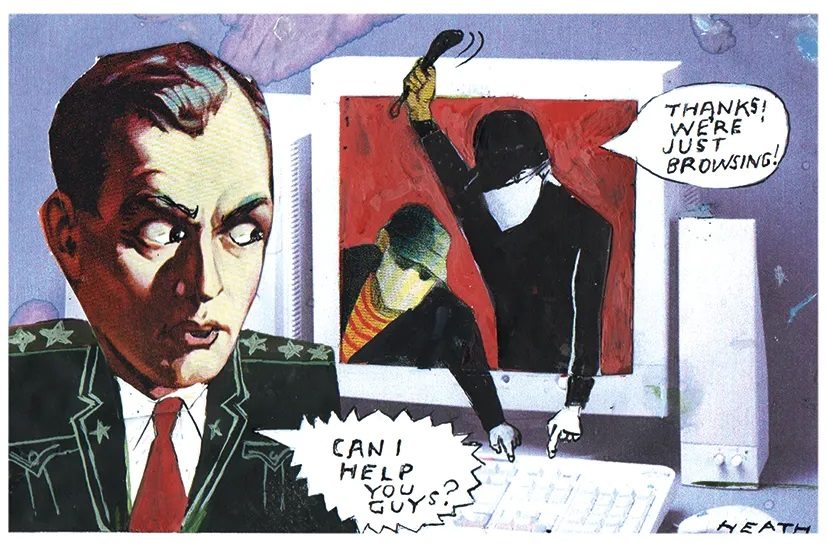

Will we see the same with crypto? Time will tell. FTX had been lobbying for regulations that would be favorable to them — but thanks to SBF and the fall of FTX we may get the regulation they weren’t actually looking for. FTX’s fall from grace is astounding — and it may only be the start for crypto.