Things aren’t going well for Tom Brady.

His team, the Tampa Bay Buccaneers, has a losing record. He is getting divorced, and FTX, the crypto exchange he was touting a year ago — and in which he was invested — has gone bust. He isn’t the only sports star with egg on his face after the collapse of FTX. Stephen Curry, Shohei Ohtani and Naomi Osaka, to name just three, also got greedy and believed the vision of Sam Bankman-Fried.

Overnight, Sam Bankman-Fried has gone from crypto wunderkind to infamous huckster. The celebrities, influencers and traditional media outlets that helped make him a star shouldn’t be allowed to absolve themselves as quickly. Brady and many others fell for the charms of cheap, easy lucre and have helped legitimize what looks like it was nothing more than a giant scam. In our networked reality, the follies of celebrities, influencers and media outlets are magnified — and their impact is intensified.

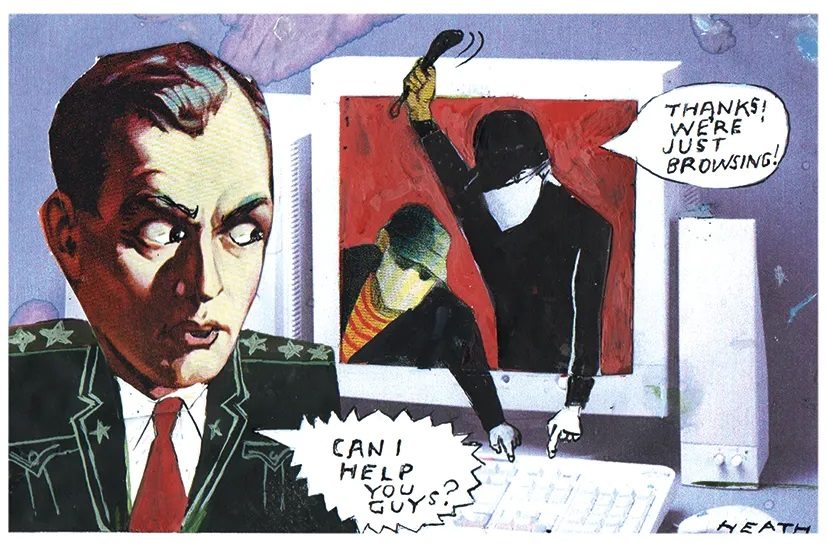

That has a lot to do with our changing media landscape. In our modern post-social era, you can hardly spot the difference between a snake oil salesman, an expert and a traditional media outlet. Social media algorithms don’t discriminate, treating every piece of content with equal respect or disdain as long as it gets engagement. FTX exploited this weakness to use social media, public relations and a savvy media strategy to become the biggest crypto brand in the world.

The strategy was ruthlessly simple and effective: feed the modern internet machine’s unquenchable thirst for content. The more engagement the creators get, the more influence they can build up; thus, they can make more money with increased attention. It is true for a small independent blogger, a TikTok influencer, a YouTuber, or a mainstream media professional. Knowing these ground rules makes it fairly easy to rig the game. Saturate the market with information and it is hard to distinguish between what is real and what is fake. For the past few years, I have seen SBF’s face adorning bus shelters and billboards. To a normal person, that was enough to legitimize SBF and FTX. After all, only the experts have their faces on billboards.

Online, it has been hard to get away from the fog of FTX and SBF. For a while, it felt as though every podcast about finance or crypto either featured SBF or was sponsored by FTX. The company also blanketed social media by getting micro and macro influencers to discuss their book. To get mainstream acceptance, FTX even roped in beauty entrepreneur Lauren Remington Platt, founder of the high-end beauty company Vensette, to target partnerships with luxury brands.

FTX built a big social media footprint and a sizable following on Instagram, Facebook, Twitter, Discord and Telegram. They roped in crypto enthusiasts who helped promote FTX and all the content shared by influencers talking up FTX. The traffic hit is like an elixir for the influencer crowd, especially for YouTubers looking for ways to game the YouTube algorithms.

So-called financial advisors on YouTube were happy to extol the virtues of FTX and hail SBF as genius — a lot of them were getting paid by the company, in some cases to the tune of millions of dollars a year in sponsorship. Their job wasn’t to give financial advice, but to make FTX a household name and generate sign-ups using affiliate links.

Graham Stephan, a YouTuber with over 4 million followers, apologized to his audience for pushing FTX on them for nearly a year. “As much as I trusted the information that I was given, I was wrong and I’m sorry,” he said. Coin Bureau, Minority Mindset, Tom Nash and Max Maher offered their apologies about FTX and their relationship with the company.

These social media personalities have played the role of railway industry periodicals during the great railway bubble of the 1800s, when Great Britain experienced a railways building boom. Railways Times, a publication that investors in railways favored, was earning £14,000 (£1.12m in today’s money) in advertisements from railways companies per issue. That helped prop up the railways’ bubble. Other pamphlets, such as “The Short and Sure Guide to Railway Speculation,” targeted the inexperienced investor.

Those were the quaint good old days. FTX and its promoter SBF did the same thing but better — and at a global scale, thanks to the Internet.

Worse than the YouTubers and influencers, though, are traditional media outlets, including Forbes, Fortune and Bloomberg Markets. These financially savvy media publications should have known better — and they should have been asking tougher questions of the FTX founder.

How does a company go from being worth next to nothing to being valued at $32 billion in just over three years? That stratospheric rise alone should have raised some serious questions. The old Forbes, under the leadership of pugnacious editor-in-chief, the late Jim Michaels, would undoubtedly have had reporters looking under the floorboards. Instead, we got a fawning profile in the Billionaires Issue, with the then twentysomething gracing the cover. Fortune did one better, proclaiming Bankman-Fried the next Warren Buffet — what a diss for the Oracle of Omaha, who has consistently made money for a few decades and is a noted crypto-skeptic.

In a classic case of shutting the barn door after the horse has bolted, Forbes published a story that began with a half-hearted mea culpa: “As the autopsy of Sam Bankman-Fried’s crypto empire begins, it’s worth saying that there were red flags all over the place. We missed them.” No kidding, Sherlock. “It was all bullshit, of course — and I didn’t see through it,” Jeff John Roberts, author of Fortune’s cover story, wrote in his newsletter. “Like any good con man, SBF told us a story we wanted to hear and were eager to believe.” That’s cold comfort to any retail investor who read those stories and decided to put their hard-earned cash in the hands of a conman.

Roberts (who at one point worked for me) is a seasoned, hard-nosed reporter and almost always skeptical of everything. I was flummoxed by the fact that he got hoodwinked. I am not a crypto-reporter and I find the industry’s jargon tedious. And even I, with a handful of phone calls, was able to learn about SBF’s psychopathic behavior and disdain for his customers and their money. Surely, crypto-reporters with a better Rolodex should have known better.

I reached out to Roberts to ask him what happened.

“Despite fifteen years of experience and a professional inclination to be skeptical, I got blinded by the narrative,” he admitted in a message. “In SBF’s case, I liked the aw-shucks nerdy affect — and that, unlike the one-dimensional libertarianism of most crypto founders, he was versant in philosophy and poetry and social justice issues. He seemed the sort of person that we in the media want CEOs to be.”

Media folks were taken in by his pedigree: his parents are Stanford Law professors. The idea of donating all his money, his work at Jane Street Capital and, more importantly, the backing of the likes of Sequoia Capital acted as good social signals for media folks. “I mean, how could all these smart people be wrong,” Roberts wrote in a note. “But in the end, I blew it. In a rush to crown him, we didn’t do the necessary homework.”

“In general, the press goes along with the crowd,” said Andrew Odlyzko, a University of Minnesota professor who has written extensively about manias and bubbles. When working at Bell Labs, Odlyzko argued that the notion of “internet traffic doubling every 100 days” was bunkum. At the time, no one believed him, because everyone wanted to believe that the Internet and the bandwidth boom were real. But it was a lie that helped inflate the telecom bubble. Eventually, he was proven right and the house of cards came crashing down.

“Part of it is that journalists are part of the crowd and get caught up in the mass delusion,” said Odlyzko. “And part of it is ‘willing suspension of disbelief’ that is accentuated by the need to attract readers, which forces folks to emphasize the spectacular.”

In this age of networked media, as I explained above, the delusion is much larger, the impact much wider and the ultimate pain much more profound. The apologies of YouTubers and mea culpa of reporters are not enough. SBF might have been the field marshal of this con job, but the influencers were the soldiers, the celebrities were the officer class — and the media were like medics. All of them helped FTX fill its coffers, only to then lose it all.

As for Tom Brady, here’s the bad news. He can’t even claim to be the first celebrity to get taken to the cleaners. After all, even the big-brained Sir Isaac Newton and author Daniel Defoe got taken for a ride during the South Sea Bubble in the 1700s.