Last year, Austin scored a major coup when it landed Consensus 2022, a big in-person conference focused on the digital finance industry, specifically cryptocurrencies like Bitcoin and Ethereum.

CoinDesk, a news and research company focused on the cryptocurrency industry, chose the Texas capital for its return to an in-person conference and it arrived splashy and huge, taking over not only the Austin Convention Center but several adjacent hotels and event spaces, its 17,000 attendees swarming downtown.

This was June of last year. Three months earlier, South by Southwest, the city’s long-running big tech and culture conference had been a veritable playground for NFT enthusiasts, and dozens of panels hyped the transformative importance of the blockchain. This was before the crypto and NFT wave broke. Earlier last year, a bunch of Super Bowl ads had hyped crypto companies that, by the end of 2022, had either gone bankrupt or allowed speculating newbies to lose a lot of money when the digital currency markets crashed hard.

Consensus 2022 felt like a giant bubble protecting its attendees from the dark storm clouds around their world. It featured a giant “Long Live NFTs” mural, the debut of CoinDesk’s own cryptocurrency, DESK, and music performances by Disclosure and the duo Method Man & Redman. I wondered then if attendees were willfully ignoring the evaporating goodwill from anyone outside their industry or if they were just perpetuating the scam to draw a few last suckers in.

The mood was very different at Consensus 2023 this April, where the mostly twenty- and thirty-something attendees were a mix of expensively-suited entrepreneurs, T-shirt-clad promoters of this coin or that, and the odd person costumed in disco gear or exaggerated cowboy attire. Udi Wertheimer leaned into the branding of the company he co-founded, Taproot Wizards, by wearing a big, sparkly wizard hat at his panel. This time around, the outside world had intruded on the festivities. The crypto crowd was back in Austin, but the conference was understandably less sprawling and ambitious than a year earlier. Most of it was contained in the Convention Center itself with just a small amount of spillover to a nearby gallery space and a few satellite parties.

There were fewer off-site events; expo-hall swag was mostly limited to candy and T-shirts; and one lunchtime meetup I attended for Latinos in the industry had neither food (what, no tacos in downtown Austin?) nor alcohol; just one sad coffee dispenser and cups atop a sober bar.

(Call me shallow, but you can tell a lot about the state of a tech sector by how much its representatives spend at conferences on details and presentation: well-known entertainers or celebrities, booth swag, free food and drinks, eye-catching activations or expo-floor setups.)

But while the frills were fewer, the mood wasn’t downcast. Instead, it was defiant in the face of a wave of bad news for all things crypto. Despite a major exchange disaster, warnings from the SEC against major crypto players and a “crypto winter” that had decimated cryptocurrency values since the last Consensus, attendees were no less convinced that they were building the financial system of the future.

Kevin Rose, a longtime tech maven and broadcaster who founded Digg, spoke on a panel that asked, “What Will History Say About This Moment in Web3?” capturing the prevailing mood across the three days of programming. “We’re still in early days,” Rose said. “People might not even remember the downturn. NFTs could return in a market that is pervasive, people won’t remember that it was scammy. To judge a technology or a founding team based on three, six, eight months I think is premature.

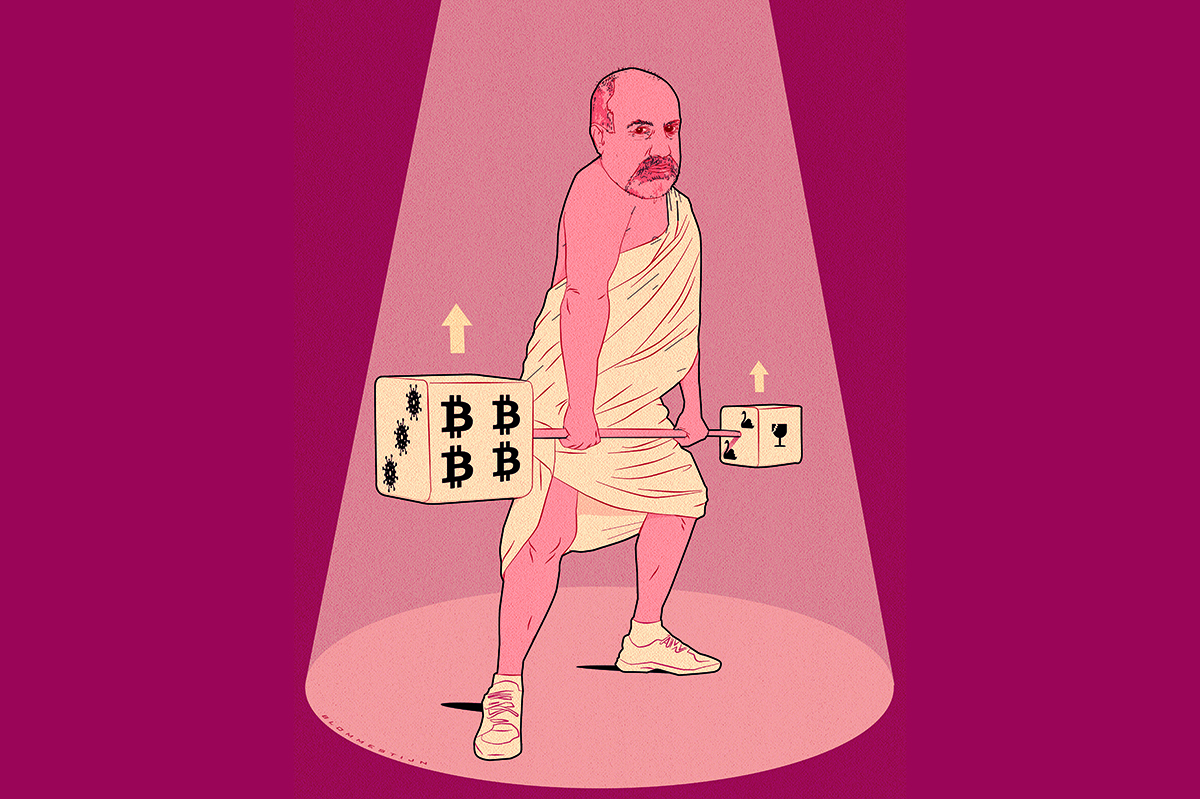

“What is the new norm now that everything has gone to shit? Nothing about the technology is broken,” he added. Those who really care about the so-called “Web 3.0” space, which promises more decentralized ownership of the online world, are going to remain committed, even religiously so, even if a lot of people outside tech now perceive cryptocurrency as a Wild West of scams and exchange collapses.

Speakers and signage around the event encouraged attendees to keep working (“WHAT WILL YOU BUILD?” challenged one omnipresent video blip), to keep buying and hoarding those coins, to continue to think about ways blockchain technology could revolutionize the world economy and supplant struggling banks. The new hope: ride up what may be a new crypto spring as some cryptocurrency prices have rebounded from their major drops last year. Quietly invest and build in the winter and reap the profits of a hot crypto summer sometime in the future.

Even as hope springs eternal at Consensus, and patience is high even as the mainstream tech industry lays off hundreds of thousands of workers, attendees I spoke to and speakers I listened to did acknowledge the huge challenges that lie ahead.

They include persuading the general public that the crypto industry isn’t a giant scam; finding ways to make the blockchain more useful; harnessing technology like AI without it getting out of control; and gaining legitimacy through government regulation.

Yes, you read that correctly. The decentralized crypto industry, which for years was defined by its libertarian zeal, now wants the feds at its door. A survey taken by CoinDesk and presented on the last day of the conference showed that attendees believe regulation is the most important issue facing crypto in the US, followed distantly by “public image.”

Crypto companies have been weighing whether they should stay in the US after receiving mixed messages from the SEC about its enforcement of securities laws. The question at the heart of the uncertainty: are cryptocurrencies like bitcoin securities or are they commodities? The SEC has not given clear guidance; at Consensus speaker after speaker said that companies need more clarity in order to move forward. Banking, they said, is a challenge for crypto companies; they are not seen as safe investments and have trouble getting even basic corporate banking services in the US and other countries.

Consensus speakers noted they didn’t have much faith that the executive branch would intervene; neither former president Donald Trump nor President Joe Biden have made any commitments to the industry. But late Friday afternoon, at the very end of the conference, a political news drop gave some hope. Congressional crypto enthusiasts Representative Patrick McHenry (via video) and Senator Cynthia Lummis (in person), both Republicans, told a panel that they are working on holding joint public hearings and putting together bills that would address digital-asset regulation.

“There’s lots of turmoil around traditional and digital assets, and reticence around this subject for lawmakers,” Lummis said. “We need responsible, understandable regulation of digital assets. We intend to roll our piece of legislation on the Senate side sometime in the next six to eight weeks.”

As badly as the Consensus crowd wants regulation, it won’t fix some of the issues that have been inherent in the industry since bitcoin began blowing up, and the coin market began to be seen as a big speculative gamble. For one thing, crypto boosters need to stay out of their own way and stop making things worse.

In his panel, Kevin Rose warned that infighting, including arguing about new projects on Twitter, doesn’t help the industry. “We can’t keep putting each other down,” he said, “we need to lock arms and work together.”

Infighting’s not the only problem; hype is another. The crypto crowd are not good at expectation management. In an interview at Consensus, entrepreneur Balaji Srinivasan, a leading crypto enthusiast, had to walk back his March prediction that bitcoin would reach a price of $1 million by June 17 (as this magazine went to press, it sits at less than $30,000 per bitcoin). He said he may have lost the $1 million bet he made, but he told the audience, “I may be wrong, but I’m burning a million to tell you they’re printing trillions.”

Throughout the event there was much discussion of the possibility that as US banks fail at an accelerated rate, cryptocurrencies like bitcoin could be seen as safer long-term investments. But if the industry is going to present itself as a haven for people’s dollars and business operations, it’s going to have to demonstrate it can be trusted. The FTX exchange collapse last winter exposed extremely shady business practices, to put it mildly. Online exploits lose crypto users hundreds of millions of dollars regularly. Even so-called “stablecoins,” supposed to be the safest assets in the space, can implode spectacularly. So perhaps the sector should clean itself up and avoid even the hint of scams or false promises, even those intended as innocent marketing. A crypto company called Hundrx hosted a launch event at Consensus. “And guess what?” its invitation promised, “Elon Mask will be there to speak!”

For bleary-eyed attendees partying and talking crypto till the Austin wee hours every night, the intentional typo was easy to miss: “Mask,” not “Musk.” But given that Musk moved Tesla’s headquarters to Austin and lives in town, it was understandable that attendees might RSVP expecting to get some face time with the city’s most famous billionaire, who is a fan of cryptocurrencies. Who or what was “Elon Mask?” Not the man many attendees hoped.

Consensus 2023 exhibited a great deal of energy and positivity; the industry will need lots of both to win back the faith of major investors, regulators, lawmakers and all those small-time customers who watched the Super Bowl, thought they were seeing the opportunity of a lifetime, and lost money they will never get back.

This article is taken from The Spectator’s June 2023 World edition.