The Paris stock market is soaring. French bonds are rising once again and the banks are suddenly looking a lot healthier. As the results of the French elections came through overnight, and it looked less likely that Marine Le Pen’s National Rally would have enough votes to form a government by itself, investors started to buy into France. Sure, the result might be messy, but chaos is a lot better than the shambolic mix of protectionism and welfare spending that passes for an economic plan for the NR. But hold on. In reality, the crisis has just been postponed — and the crash when it comes will be far worse.

The blunt truth is that France is heading into a long period of political chaos

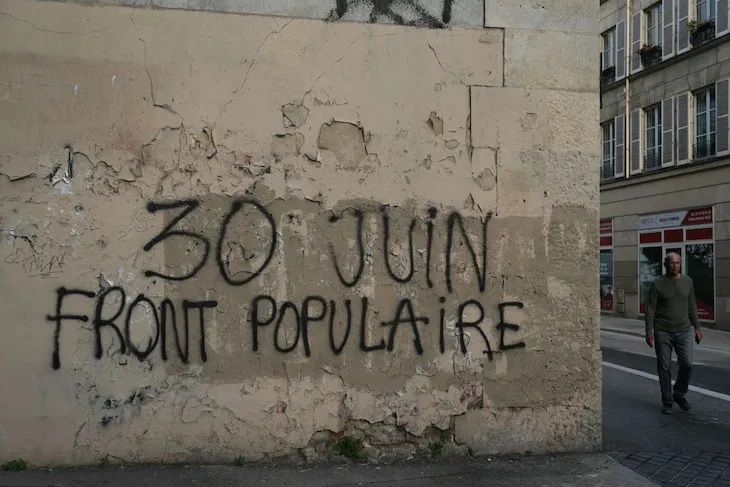

It was certainly a good morning for French assets. In early trading, the benchmark CAC-40 index rose by 2.4 percent, its best daily performance for two years. Shares of banks such as Societe Generale rallied by more than 5 percent, and bond prices that had been hammered in the run up to the election started to rise again. The explanation? Le Pen’s party slightly underperformed, and now looks less likely to win an overall majority in the second round of voting next Sunday, while President Macron’s centrists and the left-wing Popular Front may be able to stitch together local deals to lock the NR out of power. The net result will be a paralyzed parliament that won’t be able to do anything.

True, given some of the wilder policy pledges from the RN, such as slashing VAT, or exempting anyone under thirty from income tax, deadlock may well be the best outcome. Doing nothing is better than doing something crazy. And yet, in reality, investors are jumping to the wrong conclusion. The blunt truth is that France is heading into a long period of political chaos with debts that are quite clearly unsustainable. Its total debts have reached 112 percent of GDP and are now among the highest in the developed world after Japan and the United States, both of which are far larger economies. France is running a deficit of over 5 percent of GDP, even when the global economy is recovering. Its credit rating has been cut twice in the last six months, and the European Union has already started an “excessive deficit” process to try and curb the amount it is borrowing every year.

Against that backdrop, almost 70 percent of the French electorate voted for even higher taxes, and far more spending, either with the NR, or with the collection of far-left parties that make up the Popular Front. The centrists, who at least pay occasional lip service to deficit reduction, although doing very little in practice, fell to just 20 percent of the vote. Doing nothing hardly seems like an outcome to cheer. For the next two years, the debt burden will simply rise and rise. True, the markets were relieved today that Marine Le Pen did not sweep to complete power. And yet, investors are celebrating too soon. The French debt crisis has simply been postponed — and when it finally comes, the crash will be far harder.

This article was originally published on The Spectator’s UK website.

Leave a Reply