Dame Edna Everage says one of life’s most precious gifts is the ability to laugh at the misfortunes of others. You may lament this instinct, yet we all harbor it. New Yorkers are especially prone when it comes to property envy. Every couple of years, it feels like, a skyscraper goes up in the city that is significantly taller than the previous very tall new skyscraper. Each time one does, the only thing that goes higher than the tower’s residences is the cost of purchasing them. So with what rapture do New Yorkers read about the misfortunes these buildings go through. Oh, the thrill of learning that they sway in the wind, that people get seasick in the penthouses, that when owners put their garbage in the trash chutes the noise on the lower floors is like a tactical nuke.

Reading such stories makes the whole city’s heart lift a little. Everyone gets to think, if not say: “Well, I may be down in the dumps, paying through the nose for rent, but at least I didn’t spend 150 million bucks I don’t have buying a penthouse that sways.” So it is that this snippet of adversity makes everybody’s day that bit happier.

It is the same with the news last week that a cryptocurrency exchange called FTX has collapsed with between $1 billion and $2 billion of customers’ money having vanished.

Why should I take any special pleasure in the collapse of such a company? Not because I have anything against crypto, but solely because of the way the founder of FTX behaved. The firm put a particular emphasis on ESG. Please do not get lost in these acronyms.

As everybody who has brushed against big business in recent years will know, ESG stands for “Environmental, Social and Governance” and it rules the corporate world. There was a time when a company might aim to make money for itself and/or its shareholders. If it wanted to do some good works, it might set up an almshouse, a school for urchins or the like.

Today when you want to show that you really care — as opposed to actually caring — then you talk of how concerned your company is about ESG. Firms are even rated by their ESG scores. It is a great medieval Vatican-style scam. And it is everywhere.

In any case, FTX was big on ESG. On a video from January this year the company’s founder Sam Bankman-Fried and the vlogger Nas Daily — the first a shyster, the second possibly a naif — claimed that FTX existed only to make money that could then be given away. The two young men are weirdos in different ways — but the main one, Bankman-Fried, looks about fourteen and has a face like a stress ball being scrunched by somebody who’s very stressed indeed.

This pair talk about all of the things that our age values most, claiming as they do that making money to pass on to special causes is much better than merely getting rich and buying a Lamborghini. If you make money and give it away to these causes, they say, that makes you way more happy than spending it on yourself.

With some infelicitous turns of phrase, Daily says various things about Bankman-Fried, which the latter then responds to. “He is funding everything you can think of: global warming” (“It’s one of the biggest problems that we have to tackle together as a world”). “Covid-19 preparedness” (“We have to be ready for the next pandemic”). “Neglected tropical diseases” (“More than a billion people suffer from them — we have to eliminate these diseases”). “And of course animal welfare” (“Animals deserve to live just like we do; it’s also why I’m vegan”).

Putting aside for a moment whether animals deserve to live just like we do, this is a pretty comprehensive catechism of our day. Bankman-Fried might have added something about BLM, but it is possible that the most up-to-date shyster knows to veer ever so slightly away from last season’s ones.

For here we are in the realm of the sort of sanctimonious fraud that our species has known throughout history. The great writers from Chaucer and Boccaccio knew these types. Many classic works of literature feature them. But one of the strangest aspects of human beings is not that we continually throw up such people but that people always fall for them.

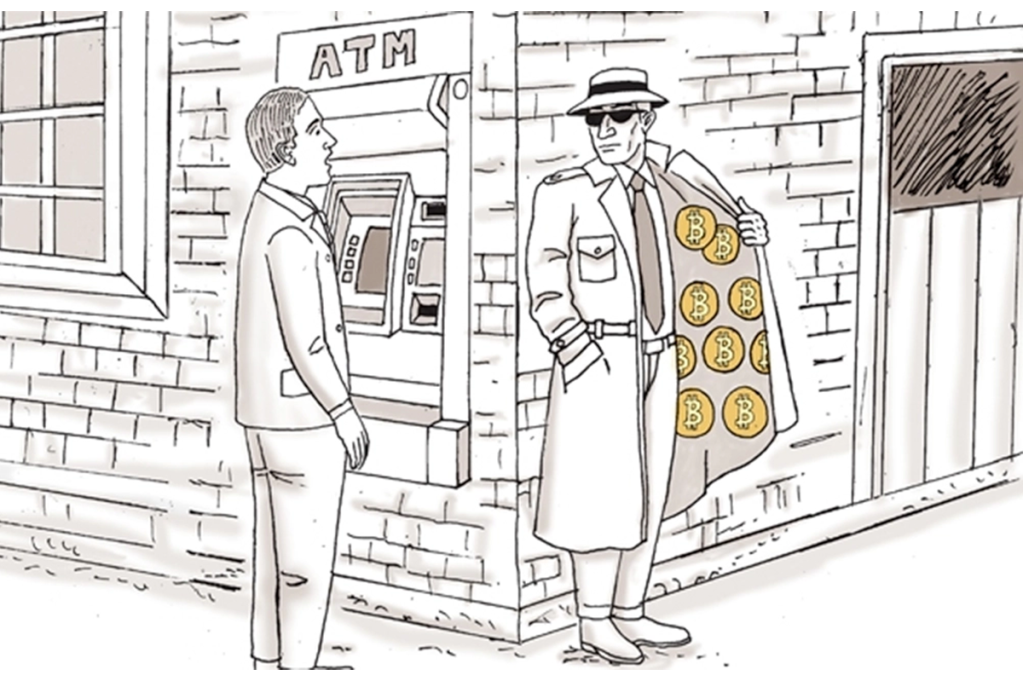

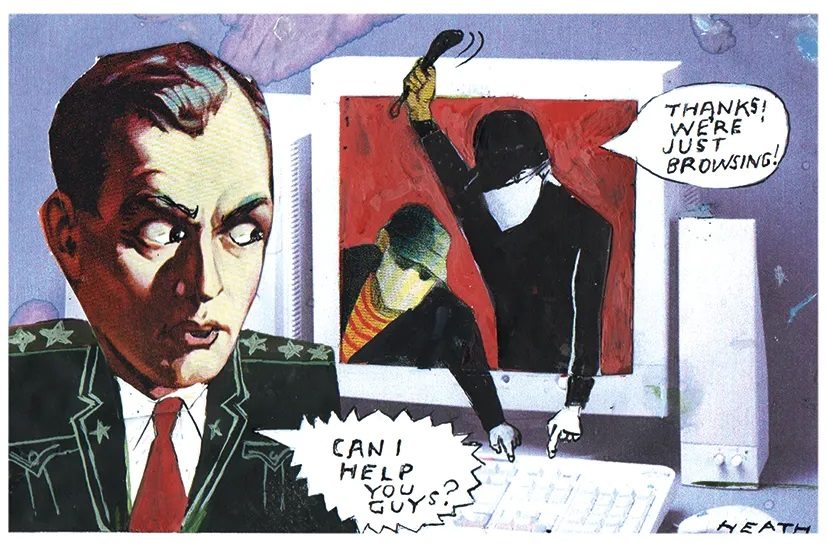

This is a matter of perennial fascination to me. If a man came around to my front door saying he had a Gucci bag which he deeply wanted to sell me and that for me the price would be a mere $50, I’d like to think I wouldn’t fall for it. If someone wearing priestly robes said they had a way to get me and everyone I loved into heaven — 100 percent dead cert, no questions asked — and all I had to do was transfer my worldly goods to him, again I’d surely know to slam the door in his face. But that’s because it’s easy to spot old cons. It’s spotting new ones that we seem to have difficulty with.

ESG — like its fellow traveler “Diversity Equity and Inclusion” — ought by now to be a great big warning flag to investors and speculators everywhere. When a firm or investment fund goes on about ESG or DEI it should cause hard-wired suspicion of the kind provoked by, say, a sinister stranger with a comb-over volunteering to look after the kids at bathtime. And yet it is not just that human beings keep making the same mistakes, it is that they make the same mistakes in subtly different ways, with the people who deceive them always prowling around to locate the weak spots of the day. I’m sorry for anybody who lost their money to these FTX crooks — these people who talked about saving the planet but instead trousered a couple of billion and did a runner. But we’ve seen them before — and a strange happiness comes from that fact.

This article was originally published in The Spectator’s UK magazine. Subscribe to the World edition here.