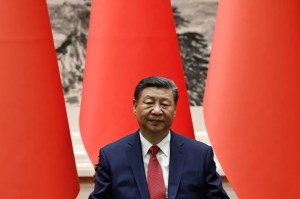

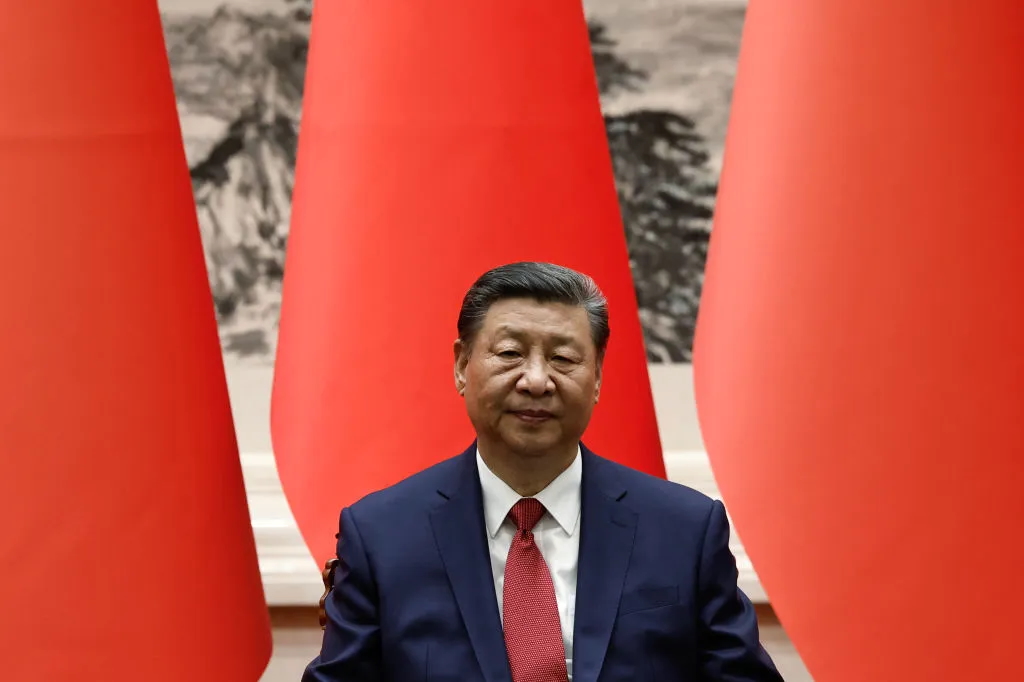

Growth is slowing down. The property market is wobbling. And the government is tightening its grip on every form of economic activity. Global investors have made a decision about China over the last few months. It may have one of the biggest markets in the world, but the risks are simply too high. Over the second quarter of this year, foreign investors pulled a record amount of money out of China. A total of $15 billion was taken out of the country, and if that continues for the rest of the year it will be the first time the total has turned negative since 1999.

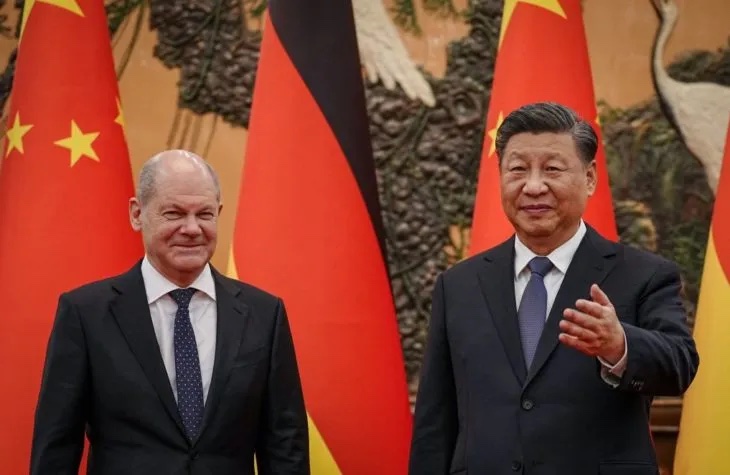

There is, however, one exception: Germany. In total, German companies invested €4.8 billion in China in the second quarter, almost double of what they invested in the first quarter, according to the Bundesbank. In the first half of the year, the total volume of direct investments by German industry came to €7.3 billion, after €6.5 billion last year, with the bulk of the money coming from the German car manufacturers. And that is despite official warnings from the government in Berlin to reduce its reliance on Asia.

Sure, it is easy to understand what they are doing. China has been a huge source of profits, and as the country becomes more protectionist they need local factories, especially as Chinese auto manufacturers are turning into real competitors.

But there are two big problems. First, the money is mostly guaranteed by the German government, creating a huge exposure for the whole of the eurozone. If China were to invade Taiwan, and there was a complete economic blockade between China and the West, most of that capital would disappear overnight, just as the far smaller investments in Russia were worth nothing after it invaded Ukraine. The German state would be on the hook for those losses, and ultimately so would the European Central Bank. Next, it makes it impossible for Germany, and by extension the rest of the EU, to operate a meaningful foreign policy, or to stand with its allies in Europe and the United States. It has too much money at stake.

The consultancy Eurointelligence describes it as “subprime” exposure, a reference to the huge bet on the American mortgage market that triggered the financial crisis 2008 and 2009. That seems right. It was one thing to bet big on China in the last decade, when it was growing quickly, and joining the global trading system. When it is allied to Russia, and threatening Taiwan, it is crazy to invest so much. In reality, German industry is far too exposed to China — and that will end up being very expensive.

This article was originally published on The Spectator’s UK website.

Leave a Reply