It could have been technology stocks such as Amazon and Zoom, of course; or government bonds; or cash; or a property, preferably in the countryside. As the COVID-19 crisis rippled around the world and locked-down economies crashed into one of the worst recessions ever recorded, there were plenty of different ways investors might have tried to ride out the storm. But there was one asset they could easily have overlooked, and yet which would have outperformed almost any of them: silver.

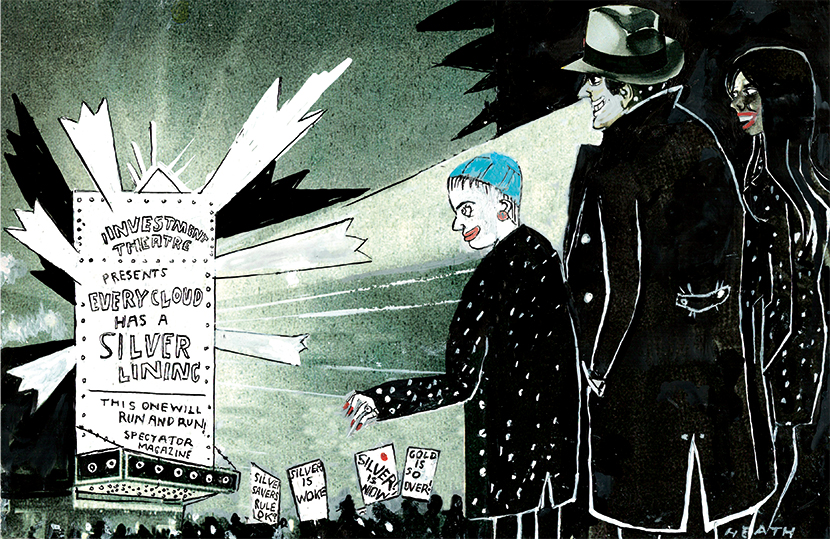

For much of the past decade, silver has been ignored as a largely irrelevant alternative to gold. In the past few months, however, it has started to shine. The precious metal has soared in price, outperforming most alternatives. And with investors nervous about the global economy, with central banks printing money like crazy, with the President of the United States diagnosed with the virus, and with rising demand from green technologies, the price could get a lot stronger yet before this bull run has finished.

When the year started, a few hundred ounces of silver in a vault somewhere would have been among the last places you would have wanted to park any spare money. The metal has always had a small group of aficionados who regard it as the one true currency, but they are generally the kind of people who store guns in the mountains, hoard food for the apocalypse and prepare for the guys from the UFOs to finally make themselves known to us. In the mainstream financial markets, it was an irrelevance. Reading through the small print of the Brexit negotiations was more entertaining than watching the silver markets. Nothing ever happened.

That was reflected in the price. In January 2015 silver was trading at $16.50 an ounce. In January this year it was trading at $17. Over five years, it slowly moved 50 cents one way, and then usually went back again. And then in March it started to race upwards. Over the course of the next couple of months it went from $17 an ounce to a high of $28. In sterling terms it has done even better, rising from £13 an ounce to £21. It was last at those levels in 2011 when it briefly spiked up to £21.

;768:[300×250,336×280,320×100];0:[300×250,320×100,320×50]”]By any historical standards, it has been a very dramatic rally. According to Deutsche Bank, the 34 percent rise in the silver price in July, compared with 10 percent for gold, was the metal’s strongest single month since December 1979. It was more than four decades since the market had seen anything like that kind of price action in silver: the last time was when the Hunt brothers famously tried to corner the market in the late 1970s, at one point owning a third of world’s supply before losing a billion dollars when the price collapsed again.

What was the trigger for that? On one level, the price was simply catching up with events elsewhere. Financial markets are seldom as efficient as they like to portray themselves, and silver had lagged behind its close rival gold for a couple of years. The price needed to rise to keep up. But there are also two big reasons why this could be the start of a much longer bull market in the metal.

First, and most obvious, silver is, just like gold, a traditional safe haven. It has been in and out of fashion as a monetary metal for the past couple of thousand years, and it is not an asset central banks store in their vaults as they do with its yellow rival. Even so, it has more or less held its place alongside gold as a way of storing wealth over many hundreds of years.

As COVID-19 plunged the world into a deep recession, government deficits soared and central banks started printing dollars, pounds, euros and yen by the hundreds of billions, alternatives to paper money became ever more attractive. A precious metal has always been a hedge against an inflationary spiral and all of a sudden that seemed more attractive than ever. Gold started to rise strongly, and its junior partner did even better.

Second, something else was happening in the background. Gold isn’t used for much except wedding rings or storing wealth. Silver, by contrast, is also a significant industrial metal. Overall, global demand hit 991.8 million ounces last year, up from 988.3 million ounces in 2018. The two big drivers of that were silver for solar panels and for use in electric vehicles. Both of those were already growing strongly as the world turned its attention to climate change, but the COVID-19 crisis has accelerated that growth. Just about every government in the developed world has launched a recovery program and ‘green technologies’ are at the heart of most of those. There will be a big switch to solar power, and electric cars are going to dominate the roads (which is why Tesla is now the biggest car company in the world by market value).

;768:[300×250,336×280,320×100];0:[300×250,320×100,320×50]”]The result? There is going to be a lot more demand for silver, and that means the price will go up.

[special_offer]

Over the past month, silver has started to stabilize again. It is back to $23 an ounce, and the price is moving within a modest daily range. Even so, it is back on investors’ radars. It has delivered spectacular returns so far this year, and has started to make up for a decade of poor performance.

With central banks still printing money, and with rising industrial demand, there is no reason why it shouldn’t head towards $30.

In truth, silver should have a place in any portfolio — and could yet make a lot more money than anyone expects.

This article was originally published in The Spectator’s UK magazine. Subscribe to the US edition here.

;768:[300×250,336×280,320×100];0:[300×250,320×100,320×50]”]